Central Bank Reintroduces Charges On Bank & Mobile Money Transfers.

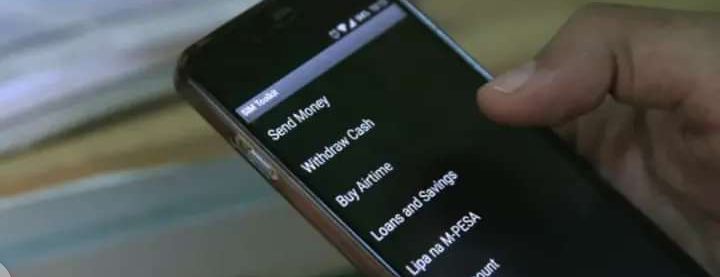

The Central Bank of Kenya (CBK) has reintroduced charges on transactions between mobile money wallets and bank accounts which had been waived on March 16 2020.

The charges are set to be restored from January 1, 2023, and follow discussions and lobbying between the CBK, banks and payment service providers with the latter two groups pushing for the fees return.

The payment service providers (PSPs) and banks have nevertheless agreed to revise the maximum charges on the transactions following consultations with the CBK.

The revised maximum charges for transfers from bank accounts to mobile money wallets will be reduced by an average of 61 per cent while the inverse (mobile wallets to bank accounts) charges will fall by an average of 47 per cent.

Tariffs for paybills used to collect and disburse funds by businesses, companies and institutions such as schools and utilities will meanwhile be reduced by an average of 50 per cent.

At the same time, charges levied by banks for bank-to-mobile money transactions will be reduced by a mean of 45 per cent.

“The revised charges for bank-to-wallet and wallet-to-bank transactions will be announced by respective payment service providers (PSPs) and banks and will be effective from January 1, 2023,” the CBK stated.

CBK has credited the waiver of the charges which was prompted by the onset of the COVID-19 pandemic with the expansion of the payments eco-system.

For instance, the number of Kenyans using mobile money increased by over 6.2 million while the monthly volume and value of person-to-person (P2P)

transactions increased from 162 million transactions worth Ksh.234 billion to 440 million transactions valued at Ksh.399 billion.

The monthly volume and value of transactions between PSPs and banks meanwhile increased from 18 million

transactions worth Ksh.157 billion to over 113 million transactions worth Ksh.800 billion.

“This outcome confirms that the mitigation measures were timely and effective, and resulted in significant benefits across the financial system.

The resumption of revised charges is aimed at building on these gains, facilitate a transition towards sustainable growth of the mobile money ecosystem,

and ensuring affordability of payment services for Kenyans,” added the CBK.