Teacher’s Employer Advices On Early Filing Of Tax Return. Take Note Of How failure To Can Affect You.

Nancy Macharia asks teachers to file KRA returns early to avoid sh. 20,000 penalty

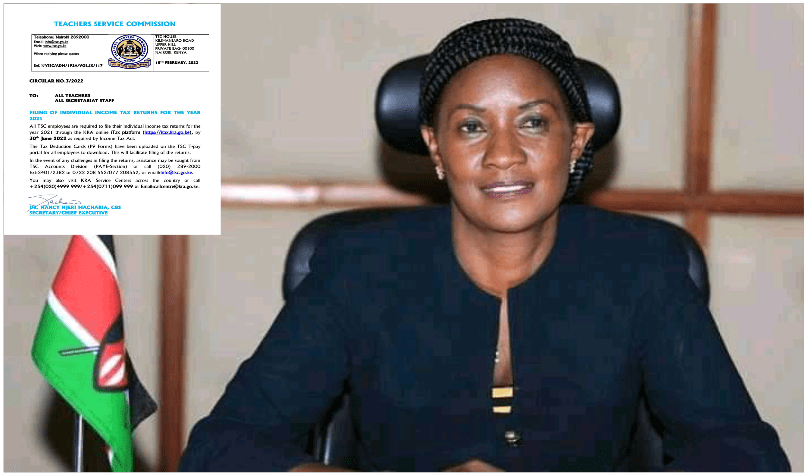

The Teachers Service Commission (TSC) CEO Dr. Nancy Macharia on 10th February 2022 released a circular targeting tutors employed by the Commission as well as its secretariat staff.

Macharia through a circular No. 3/2022 addressed to TSC teachers and Secretariat staff directs all its employees to file their individual income tax returns for the year 2021 by end June.

“All TSC employees are required to file their individual income tax returns for the year 2021 through the KRA online ITax platform https://itax.kra.go.ke/ by 30th June 2022 as required by Income Tax Act,” read part of a circular by Nancy Macharia.

She said the the P9 form have been uploaded on the TSC T-Pay portal for all employees to download to facilitate filling of the returns.

A P9 form is a form containing total income received in a year which shows an employees basic salary, allowances and benefits, gross salary, pension contribution, PAYE charged and personal relief entitlement for a year.

TSC also sent bulk SMS to teachers reminding them of the same.

“Dear Mr Felix, access your 2021 P9 form on the T-PAY portal and file your tax returns through the KRA online platform https://itax.kra.go.ke/. Deadline 30th June 2022,” read the SMS today midnight.

Failing to file KRA returns on time is detrimental to employees. The Kenya Revenue Authority (KRA) imposes penalty for those who fail to file returns on time.

The charges are pegged at KSh 2000 or 5% of the tax due, whichever is higher for individuals, while the penalty for Income Tax for Non-Individual is at KSh 20,000 or 5% of tax due, whichever is higher.

Last year KRA threatened to revoke KRA pins for all Kenyans who fail to file their tax returns before the June 30th deadline.

This move would see employees like teachers and civil servants, who failed to file returns, missing salaries as their KRA pins get blacklisted.

At the time KRA had listed on its website, 62,727 pins intended for de-registration after June 30th.

The tax collector had published notice earlier saying persons who fail to file their respective tax returns without showing cause will lose their pins after the lapse of a 30 day window.

“Failure to file returns, unless cause is shown to the contrary, the Commissioner of Domestic Taxes shall have their personal identification numbers (PINs) de-registered and cancelled from the KRA system,” read part the notice.

However KRA did not revoke the pins instead it penalized those who failed to file returns on time.

Teachers who have gone on retire have so many times revealed how it is frustrating to get cleared by KRA especially if you failed to file returns during the period of service at TSC.

“The small things which a teacher can ignore like filing KRA returns can have serious repercussions when one exits the service through retirement. I would anytime advise teachers to take the small things with seriousness,” advises Andrew Mwagala, a retired primary school teacher in Taita.

Teachers facing challenges she said can seek assisstance from TSC Accounts Division (PAYE section) or call 077208552 or email info@tsc.go.ke

Teachers can also seek assistance in filing the returns from KRA service centres or call 0711099999 or email KRA through callcentre@kra.go.ke

Learn how to file KRA returns using TSC P9 form through the video provided below.

How to file KRA tax returns for TSC teachers.